multistate tax commission members

1 It is the executive agency charged with administering the Multistate Tax Compact 1967. In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth the MTC signatory states interpretation of those in-state activities that are conducted by or on behalf of a corporation and fall within or outside the protection of PL.

Multistate Tax Commission Home

Revised July 25 2013.

. Congress in 1959 and protects businesses from the imposition of state income tax when the businesss only activity in the state is the solicitation of orders of. 2 As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. Compact membersare states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law.

Deputy General Counsel Lila Disque. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. Multistate Tax Commission with Helen Hecht Hosts Guests Judy Vorndran Meredith Smith Helen Hecht from Multistate Tax Commission MTC Transcript Transcript Email Download New Tab Multistate Tax Commission with Helen Hecht Meredith 000002 Welcome to SALTovation.

Multistate Tax Commission 444 North Capitol Street NW Suite 425 Washington DC 20001 Phone. Compact member states also help to govern the Multistate Tax Commission and regularly participate in a wide range of the Commissions projects and programs. Deputy Executive Director Scott Pattison.

Commission members acting together attempt to promote uniformity in state tax laws. Executive Director Gregory S. The compact member states are Alabama Alaska Arkansas California Colorado District of Columbia Hawaii Idaho Kansas Michigan Minnesota Missouri Montana New Mexico North Dakota Oregon South.

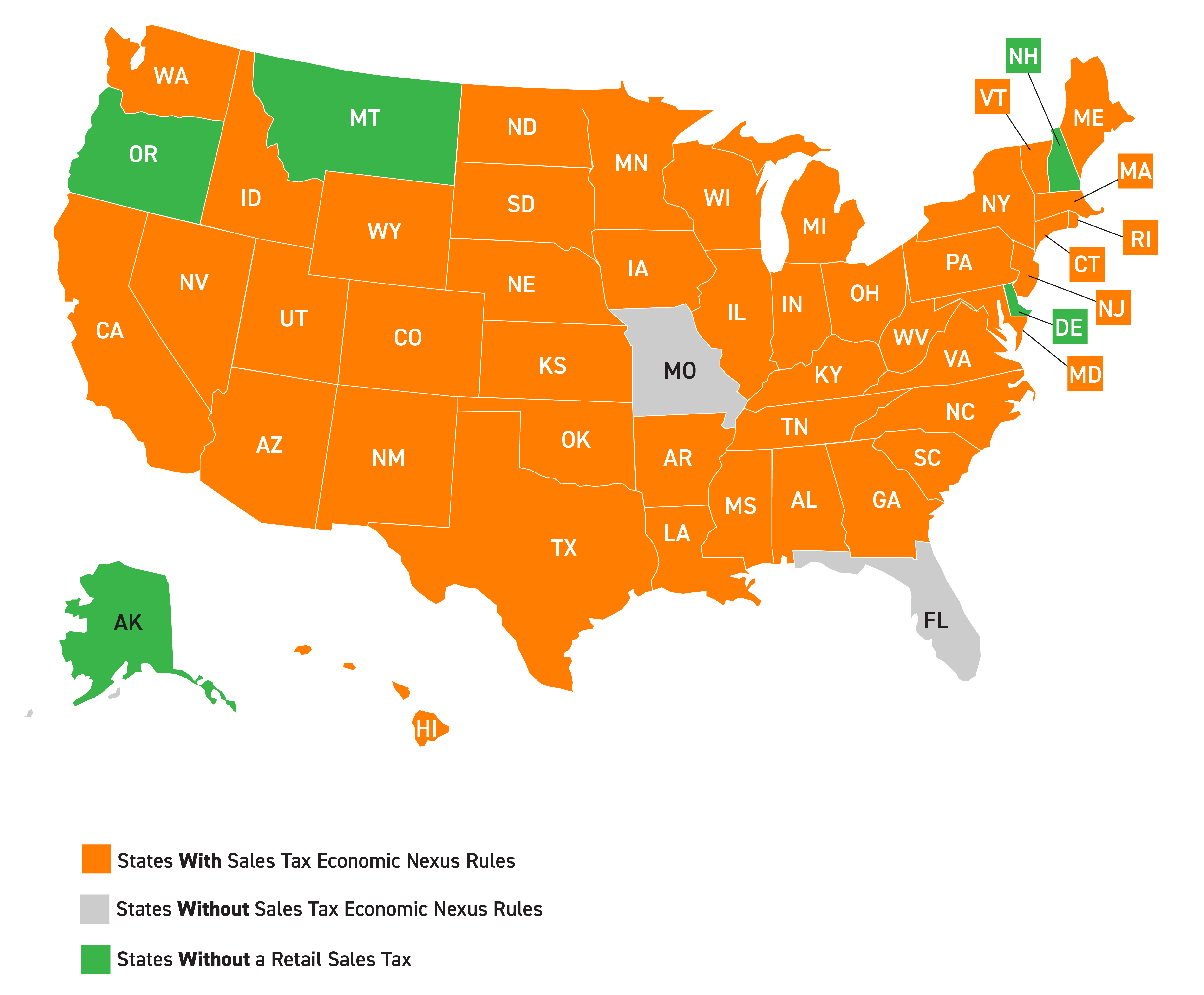

The Commission does not. These states govern the Commission and participate in a wide range of projects and programs. The Nexus Committee was formed under Article VI2 of the Multistate Tax Compact and bylaw 6 b to oversee the National Nexus Program.

This allows multistate tax payers to properly apportion their tax liabilities in a manner that does not. Company profile page for Multistate Tax Commission including stock price company news press releases executives board members and contact information. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

Each taxpayer member is responsible for tax based on its taxable income or loss apportioned or allocated to this state which shall include in addition to other types of income the taxpayer. Brian Hamer Hearing Officer Multistate Tax Commission. General Counsel Nancy Prosser.

86-272 was passed by the US. July 2014 - At the Uniformity Committees meeting the Compact Article IV work group presented its recommended changes to Compact Article IV18 c d. Sovereignty members are states that support the purposes of the Multistate.

These states govern the Commission and participate in a wide range of projects and programs. It shall be composed of one member from each party state who shall be the head of the state agency charged with the administration of the types of taxes to which this compact applies. Law360 April 25 2022 402 PM EDT -- Vermont will join the Multistate Tax Commission as a sovereignty member beginning July 1 after being approved to join by the executive committee the.

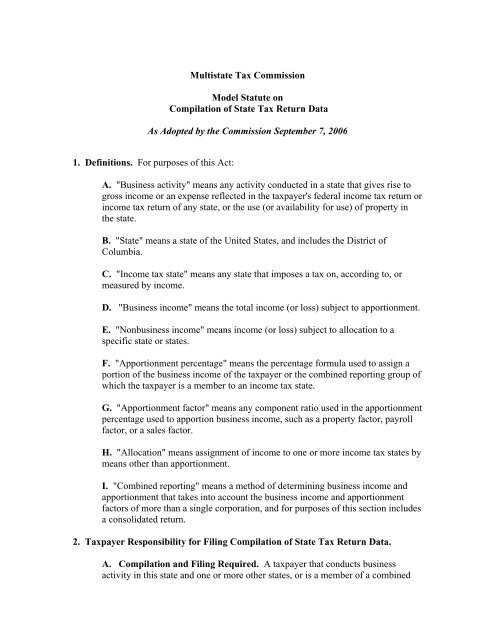

This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several months consideration a uniformity recommendation ie a model statute that requires partnerships to withhold income tax at the states highest tax rate on each nonresident partners share of the income. The recommended changes included two proposed alternatives under Article IV18 c and the Committee voted to adopt the language of Alternative 2.

The Multistate Tax Commission is an interstate instrumentality located in the United States. 86-272 income tax immunity. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity.

World Heritage Encyclopedia the aggregation of the largest online encyclopedias. The Multistate Tax Commission MTC is an interstate instrumentality located in the United States. Uniformity Counsel Helen Hecht.

Helen Hecht General Counsel Multistate Tax Commission Ms. Gregory Matson Executive Director Multistate Tax Commission Ms. There was also a change in wording to Art.

Its purpose is to create uniformity amongst state tax laws and foster fair equalization of tax base revenues. Director of Administration William Six. The Multistate Tax Commission MTC adopted its long-awaited guidance interpreting Public Law PL 86-272 protections for internet businesses on August 4 2021.

53 rows The Commission offers services to the public and member states. Multistate Tax Commission June 13 2018 Page 3 of 10. Multistate Tax Commission Proposed Model Statute for Combined Reporting As approved by the Multistate Tax Commission August 17 2006.

This alteration show is a podcast series featuring the leading voices Insult. Lila Disque Deputy General Counsel Multistate Tax Commission Mr. Created by the Multistate Tax Compact the Commission is charged by this law with.

Definition of Member States Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. The National Nexus Program is a program of the Multistate Tax Commission MTC created by and composed of member states. It is the executive agency charged with administering the Multistate Tax Compact.

Taxation in the United States. A The Multistate Tax Commission is hereby established. The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws that apply to multistate and multinational enterprises.

Exhibit A Multistate Tax Commission

.jpg.aspx)

Multistate Tax Commission News

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Multistate Tax Commission S View Of P L 86 272 Is Changing

2021 Multistate Tax Developments Dbriefs Webcast Deloitte Us

Multistate Tax Commission With Helen Hecht Taxops

Alabama Department Of Revenue Christy Vandevender Tax Policy Research Division Ppt Download

Tax Adviser March 2022 Page 43

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Chris Barber Counsel Multistate Tax Commission Linkedin

Multistate Tax Commission Home

Multistate Tax Commission With Helen Hecht Taxops

Draft Model Uniform Statute On Multistate Tax Commission

Multistate Tax Commission Home

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive